Transforming FP&A with Anaplan and valantic

Next-Generation Financial Planning

Legacy spreadsheets can’t keep up. Today’s FP&A leaders need cloud-native platforms with AI-driven forecasting, real-time data integrations, and intuitive user experiences that empower teams at all levels. Discover how to revolutionize your Financial Planning processes based on Anaplan, all with the expertise of valantic as your trusted implementation partner.

Transform your Financial Planning strategy with valantic and Anaplan

A variety of emerging trends have significantly reshaped the landscape for FP&A professionals. The growing pace and scale of economic disruptions; such as supply chain breakdowns, regulatory changes, commodity price shocks, labor shortages have intensified the strain on conventional FP&A approaches. Typically structured around quarterly or annual cycles and not equipped for rapid, real-time developments FP&A leaders are struggling to respond to these changes. At the same time, new variables, assumptions and volume of business data continues to surge, creating added complexity. As a result, FP&A teams are increasingly tasked with reconciling and consolidating this data instead of spending time in analysis to take meaning insights.

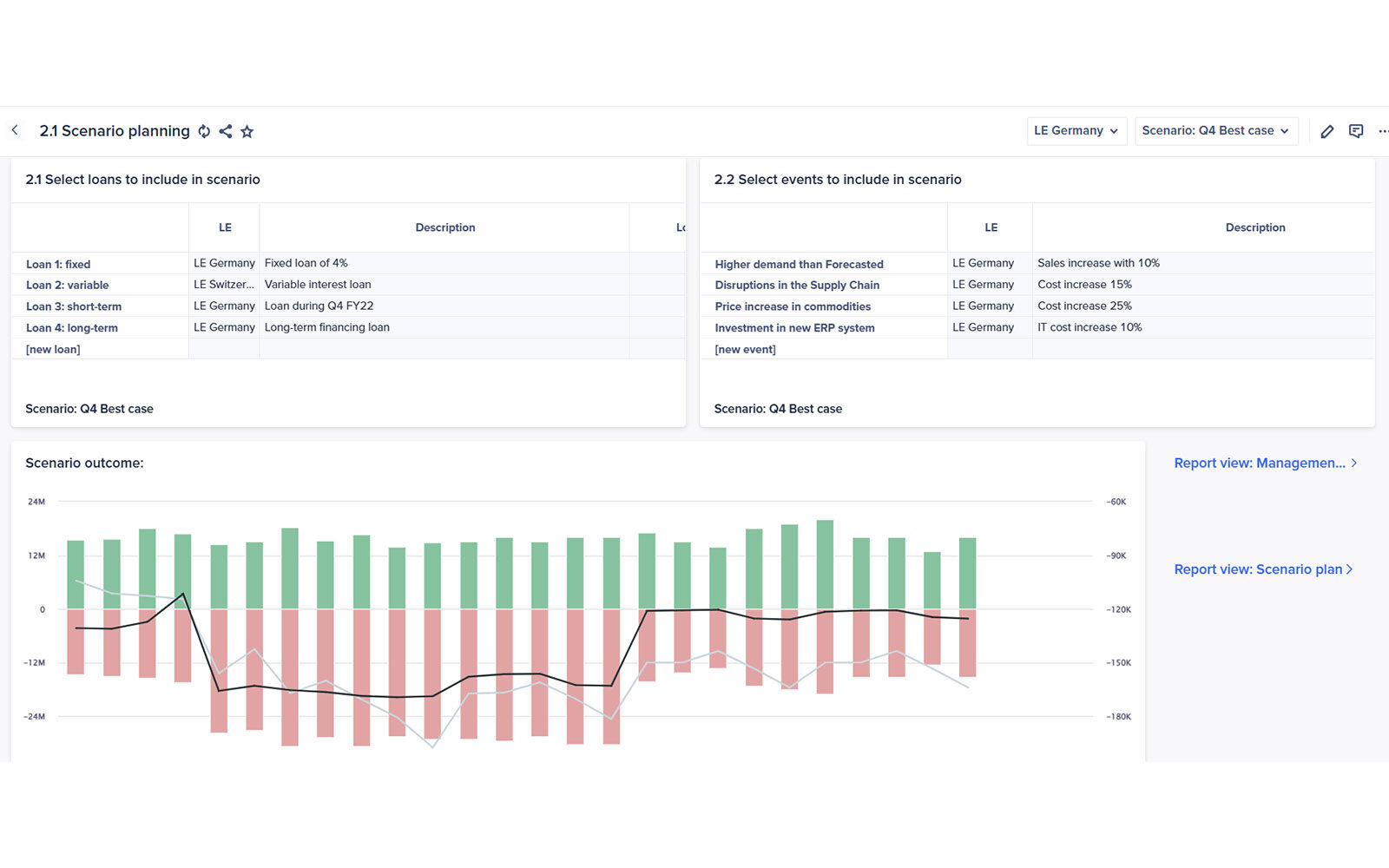

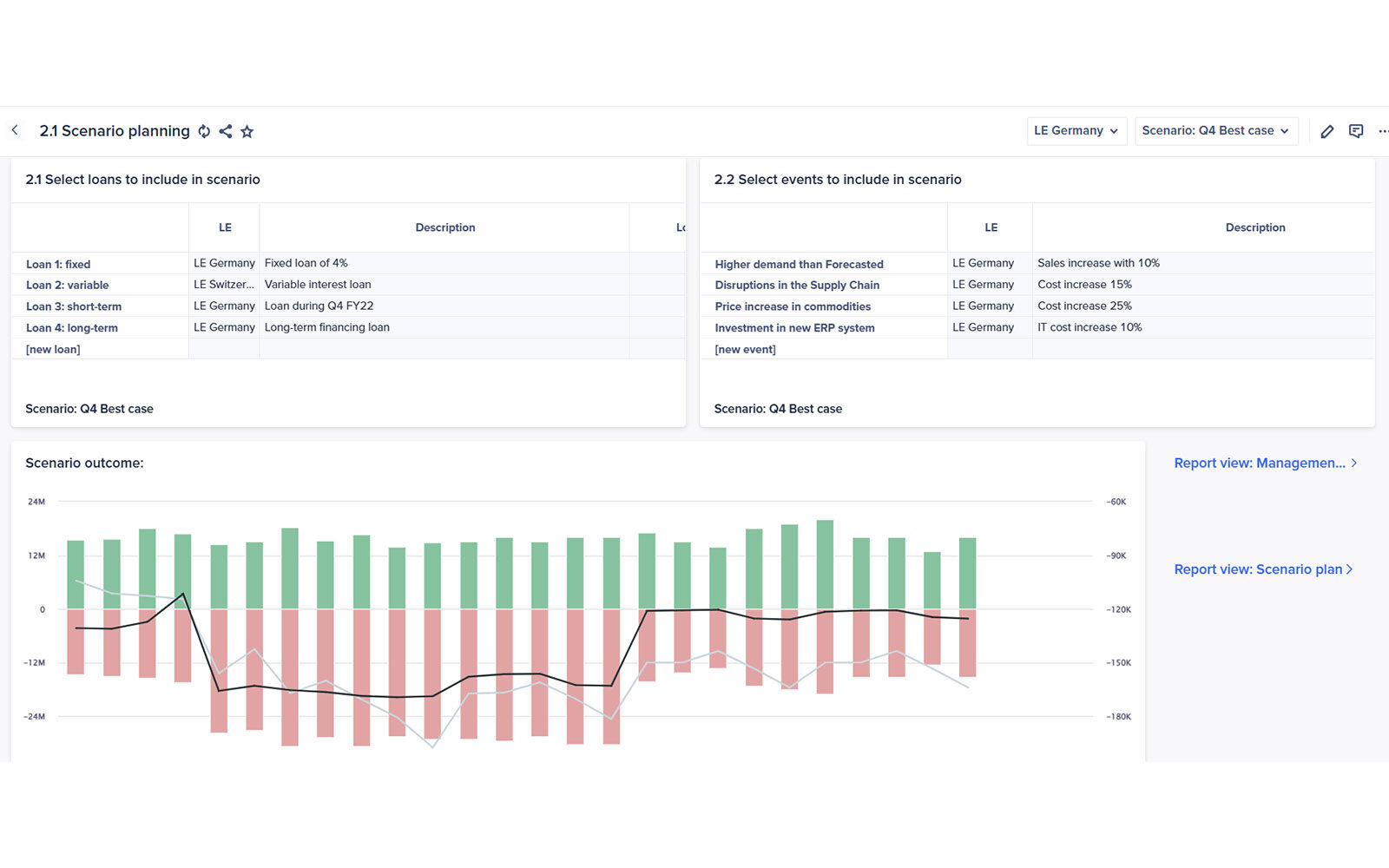

Next-Generation Financial Planning is no longer about extrapolating the past. It’s about identifying and modeling the most impactful business drivers. Anaplan enables FP&A teams to connect critical business assumptions to financial outcomes and run advanced scenario planning that informs both strategic and tactical decisions.

valantic is a leading implementation partner for Financial Planning projects across Europe, renowned for its expertise and success in finance departments across various industries. Collaborating with esteemed clients such as Avolta, SBB, and Swarovski, valantic consistently delivers innovative solutions powered by Anaplan, enabling organizations to enhance forecasting accuracy, streamline budgeting processes, and achieve strategic financial objectives.

Connect every element of your Financial Planning model

Build a unified, forward-looking financial view across P&L, balance sheet, and cash flow tailored to your industry. Anaplan enables finance leaders to go beyond static budgets and fragmented spreadsheets by offering a connected platform that brings your entire financial framework to life.

Whether you’re managing costs, funding growth, or navigating volatility, Anaplan empowers you to plan holistically across revenue, expenses, and investments; and act with confidence. Build a forward-looking view of your business by connecting every piece of your financial model:

Leverage advanced statistical methods, including regression, time series, and machine learning algorithms, to generate accurate, data-driven forecasts. Automatically detect trends, seasonality, and anomalies across revenue, expenses, and operational drivers. Anaplan’s statistical forecasting enables finance teams to reduce bias, improve forecast accuracy, and quickly respond to shifting business dynamics with confidence. Built-in scenario planning and override controls ensure flexibility while maintaining transparency and auditability.

Build dynamic, driver-based revenue models that reflect pricing, volume, churn, seasonality, and channel strategies. Simulate the impact of business growth or market disruptions across P&L, balance sheet, and cash flow.

Allocate direct and indirect costs with precision, across departments, functions, or business units. Manage operational expenses in real time, improving transparency and enabling budget accountability across the enterprise.

Forecast cost of goods sold with precision by integrating sourcing, production, and pricing data across the value chain. Dynamically model input cost drivers such as raw materials, labor, and freight ; and simulate their impact on unit economics and gross margin. Enable finance and operations teams to collaborate on cost scenarios, assess supplier changes, and optimize profitability across products, regions, and channels.

Plan capital investments aligned to strategic initiatives. Forecast depreciation, model asset lifecycles, and evaluate ROI to understand long-term impacts on the balance sheet and liquidity.

Model existing and future debt positions, interest expenses, refinancing scenarios, and covenant compliance. Understand how capital structure changes affect profitability and cash availability.

-

1/5

Statistical Forecasting & Predictive Modeling

-

2/5

Revenue Planning

-

3/5

Cost Allocations

-

4/5

Multi-Currency & FX Impact Modeling

-

5/5

Scenario Modeling

Dynamically model receivables, payables, and inventory based on operational inputs. Optimize cash conversion cycles and forecast net working capital to better manage short-term liquidity.

Evaluate capital projects, M&A opportunities, or new product launches using IRR, NPV, and payback metrics. Align investment decisions with financial targets and strategic goals.

Forecast effective tax rates and simulate impacts of business structure, jurisdictional changes, or evolving tax regulations. Ensure accurate provisioning and compliance with reporting requirements.

Anaplan enables finance teams to plan and forecast in local operating currencies while seamlessly consolidating and reporting in a designated global or reporting currency. With real-time currency conversion using both spot and forecasted exchange rates, FP&A teams can assess FX impacts on revenue, COGS, opex, and intercompany flows with full transparency. You can simulate the financial impact of currency fluctuations on profitability and cash flow, and test hedging strategies under different rate scenarios. This level of agility helps protect margins and ensures that strategic decisions are made with a true global financial perspective.

Rapidly model best-, base-, and worst-case financial scenarios using real business drivers. Evaluate how external and internal shocks cascade through the three financial statements—enabling proactive, informed decision-making.

Continuously align strategic assumptions and operational drivers across financial plans. Changes to inputs such as pricing, headcount, payment terms, or growth rates flow automatically through interconnected models—ensuring real-time updates to P&L, balance sheet, and cash flow. Eliminate reconciliation cycles, improve forecast accuracy, and accelerate decision-making with always-synced financials.

The FP&A demo video series

Watch our short FP&A demo videos to gain valuable insights into how Anaplan can help you sustainably link your business goals with financial plans.

- Episode 1: Out-of-the-box FP&A accelerator on Anaplan

- Episode 2: Intercompany Elimination

- Episode 3: Long Range Planning

Would you like to get more insights into FP&A in Anaplan? Stay tuned for the next episode, coming soon!

Build a financial planning model in just 20 minutes!

Watch our Anaplan demo video that showcases how to build a financial model in just 20 minutes. Witness firsthand the speed, agility, and accuracy that Anaplan brings to your connected planning processes. By exploring this demonstration, you’ll discover the possibilities and gain valuable insights into the capabilities of the platform.

Why modern Financial Planning needs digital transformation: Traditional vs. Anaplan

This is not all! Discover next level Financial Planning Consolidation based on Fluence

Financial consolidation with Fluence powered by Anaplan

Revolutionize your financial consolidation with Fluence powered by Anaplan—transition now to a seamless, real-time solution and elevate your finance department.

Why valantic is your ideal implementation partner

A trusted partner with FP&A experience in Anaplan

We have done this many times before and can refer to our experiences of planning and forecasting projects in Anaplan.

Deep knowledge of planning and disruptive technologies

We have extensive experiences in implementing tools and processes that help to react to changes in real time and understand the consequences across the entire organization.

Extensive financial planning and accounting know-how

We have been supporting leading organizations in their financial planning and accounting for many years and are contributors to thought leadership in the topic.

End-to-end capabilities

We offer technological and organizational end-to-end integration, from strategy to implementation, and have extensive technology capabilities that we use to support you.

Experience with firms like yours

We have worked with similar companies to yours before. Our understanding of various industries helps us to design and implement a solution that suits your requirements.

Insights in the sector

We are joined by industry experts on which you can count on which have extensive project experience with similar transformations in the same sector.

Schedule a free Financial Planning consultation today

In our commitment to elevate your Financial Planning processes, we are pleased to offer a complimentary demo and exploration call. This personalized session will delve into your organization’s unique challenges and opportunities, focusing on how optimized Financial Planning can enhance foresight, operational agility, and future readiness. During this call, we will:

Understand your pain points

We’ll listen closely to identify the specific hurdles you face in Financial Planning, ensuring a deep understanding of your needs.

Discuss improvement areas

Leveraging our expertise, we will explore areas where your processes can be optimized for efficiency, accuracy, and strategic alignment.

Demonstrate potential solutions

You’ll get an exclusive look at how Anaplan can streamline and enhance your Financial Planning process, with practical demonstrations tailored to your context.

Envision a customized approach

Together, we’ll envision how we can collaboratively elevate your Financial Planning, leveraging our technology and insights for more informed decision-making and streamlined planning.

Stay informed: Access exclusive insights and updates around Financial Planning

Your personal guide: valantic Key Success Factors

Learn first-hand from our Anaplan consultants how to sustainably transform your finance office for reliable and networked corporate planning.

Webinar on demand: FP&A Webinar Series (EN)

Future-Proofing Financial Planning – Empowering Companies with Adaptive FP&A

A Strategic Guide to Modernizing Financial Planning and Analysis

This whitepaper ventures into the realm of FP&A, shedding light on its pivotal role in guiding corporate strategy.

Your Contact

Marc Philipp

Your contact for a planning workshop or a non-binding consultation appointment.

valantic XPA AG